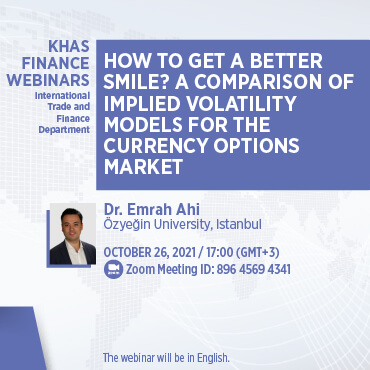

KHAS Finance Webinars – Dr. Emrah Ahi

The guest of the Finance Webinars series organized by Kadir Has University International Trade and Finance Department is Dr. Emrah Ahi from Özyeğin University.

We develop a robust and parsimonious model for the implied volatility curves of currency options. The novelty of our approach is to apply the Nelson-Siegel factorization across the “moneyness” dimension of the implied volatility curve. Its merits appear when we implement the model for 10 currencies between 2006 and 2020 and compare our results to benchmark models. We find the model parameters, called latent factors, are consistently stable and economically interpretable. They closely track the at-the-money, risk reversal and buttery quotations, namely the primary factors for pricing currency options.

Since the parameters feasibly capture dynamic changes in implied volatilities, in-sample and out-of-sample errors of the model are 10- 20 percent lower than the errors of the benchmark models. The model’s predictive performance is more pronounced for shorter forecast horizons and Emerging market currencies. Our findings highlight the benefits of “sophistically simple” implied volatility models for effective management of risk exposures.

The webinar will be in English.

About the speaker:

Dr. Emrah Ahi is an Assistant Professor in Finance at Özyeğin University where he has been a Business Faculty member since 2019. He is also a researcher at the Center for Financial Engineering. Previously, he worked as a fund manager at HSBC Global Asset Management between 2016-2019. Dr. Ahi received his BA degree from Middle East Technical University in 2004 and his MS degree in Computational Sciences and Engineering from Koç University in 2007. He received his PhD in Business Administration from Özyeğin University in 2016. His research interests lie in the area of fixed income securities, asset pricing, derivatives, credit risk and machine learning.

Date: October 26, 2021 (Tuesday), 17.00

Title: How to Get a Better Smile? A Comparison of Implied Volatility Models for the Currency Options Market

Zoom Meeting ID: 896 4569 4341

Zoom Link: https://us02web.zoom.us/j/89645694341